- DOWNLOAD TURBOTAX 2014 PLUS HOW TO

- DOWNLOAD TURBOTAX 2014 PLUS INSTALL

- DOWNLOAD TURBOTAX 2014 PLUS UPGRADE

- DOWNLOAD TURBOTAX 2014 PLUS SOFTWARE

- DOWNLOAD TURBOTAX 2014 PLUS WINDOWS 7

H&R Block offers multiple guarantees for its services and has many useful features, including a tax calculator. For just $89.95, H&R Block Premium and Business will prepare and e-file both your personal federal and state returns (Form 1040) and your federal and state business returns (Forms 1120, 1120S, and 1065). With H&R Block desktop software, you can prepare the entire bundle of required returns for business owners for a low fee.

DOWNLOAD TURBOTAX 2014 PLUS SOFTWARE

H&R Block: Best Inexpensive Desktop Tax Software for Corporate and Partnership Returns

DOWNLOAD TURBOTAX 2014 PLUS HOW TO

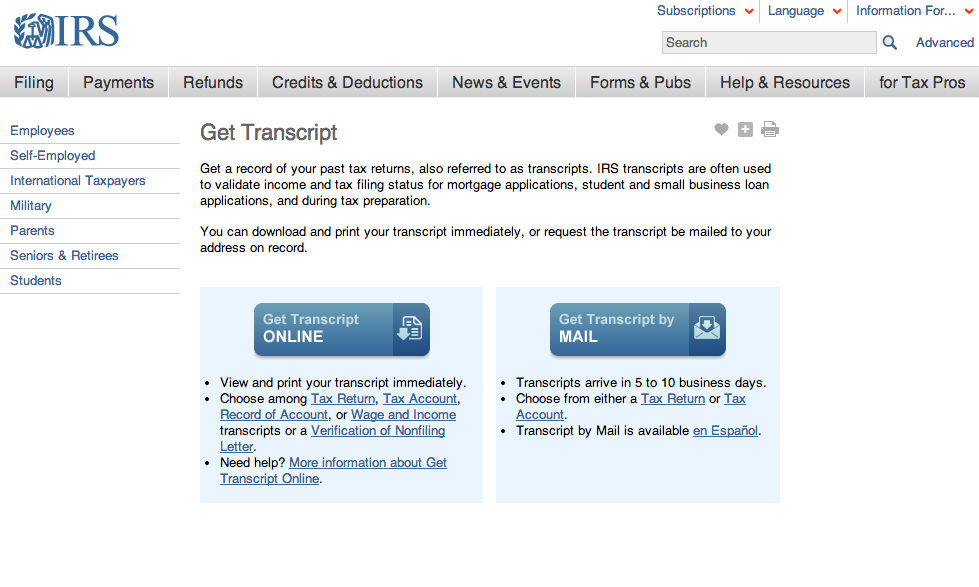

Its Audit Support Guarantee gives you free one-on-one audit guidance from a trained tax professional and assistance with what to expect and how to prepare for the audit.

However, if you’re only looking for audit assistance, TaxAct is lacking in this area, with only an FAQ page on its website. While TaxAct does provide audit defense via its partner company Protection Plus, the cost is $49.95 and covers three years of audit services. Many small business tax programs offer some kind of audit support, whether that’s providing advice, consulting, or defense. You can get answers to your tax questions in its Answer Center, but you can’t talk directly with a tax professional. TaxAct provides a link from the interview to the help section that explains exactly how to format your CSV file or spreadsheet for import. Income and expenses can be imported from virtually any bookkeeping software by means of a CSV file. The dashboard also provides useful tools like a quick tax estimator and tax planner. Start as many returns as you like and only pay when you’re ready to file. You can start a new return of any type with one click that begins the TaxAct interview process. TaxAct has a dashboard that shows all your current and prior-year returns filed with TaxAct Online.

It also provides an accuracy and maximum refund guarantee, a tax calculator, and a deduction maximizer. You can learn more by clicking here.TaxAct is ideal for businesses that want one-on-one tax assistance and also businesses that need to file corporate or partnership returns.

DOWNLOAD TURBOTAX 2014 PLUS UPGRADE

We recommend upgrading to Windows 10 for the highest level of security, but you can upgrade to Windows 8 or 8.1 and still use TurboTax without these risks. You’ll need to upgrade to a newer version of Windows next year.

DOWNLOAD TURBOTAX 2014 PLUS INSTALL

DOWNLOAD TURBOTAX 2014 PLUS WINDOWS 7

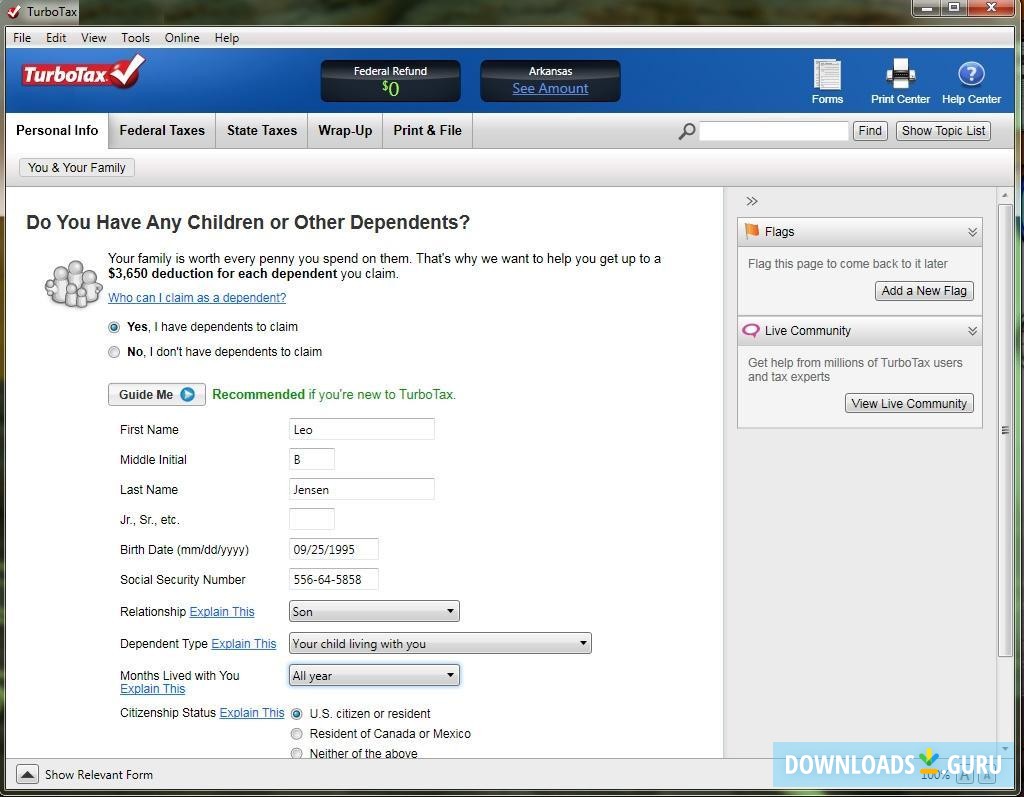

TurboTax for tax year 2019 will install on Windows 7 (Service Pack 1 or later), but when TurboTax for tax year 2020 is released, all TurboTax desktop products will cease installing on Windows 7.Īnd while you can still use TurboTax 2019 on Windows 7 (Service Pack 1 or later), there are a couple risks in doing so: Because Microsoft will no longer provide security updates or support for PCs running Windows 7 or Windows Server 2008 starting on January 14, 2020, we strongly recommend that desktop customers using Windows 7 upgrade to Windows 10 before installing their product.

0 kommentar(er)

0 kommentar(er)